New reporting method effective 2018

美国国税局(IRS)成立于2018年, required colleges and universities to report “the total amount of payments received for qualified tuition and related expenses from all sources during the calendar year less any reimbursements or refunds” on a 1098-T. 1098- t表格必须在上一个课税年度/公历年度的每年一月发出. JCC reports payments that were received during the current calendar year for qualified tuition and related expenses.

Please be aware that the responsibility for your individual tax circumstances rests with the taxpayer alone, JCC对您对此信息的解释不承担任何责任. If you have questions or need further assistance please contact your tax advisor or refer to the Internal Revenue Service (IRS) Publication 970.

什么是1098-T表格?为什么我需要它? All eligible educational institutions must file a Form 1098-T to report information to the Internal Revenue Service (IRS) for the amount billed to you by JCC over the course of the previous calendar year .The purpose of the 1098-T is to help you and/or your tax professional determine if you are eligible for an Education Tax Credit. Please note that your 1098-T form may not provide all of the information you need to determine eligibility for tax credits and deductions. Eligibility for any tax benefit depends upon your individual facts and circumstances and the JCC cannot provide you with any tax advice.

When will I receive my 1098-T? 选择以电子方式取得1098-T表格的人士, 表格将在1月31日之前的某个时间提供. For those opting to receive a paper form, 1098- t将在1月31日前邮寄到符合条件的学生的永久地址.

要以电子方式取回1098-T表格,你必须选择加入 and give consent to receive your 1098-T form electronically:

Step 1: Website: http://heartland.ecsi.net/index.main.html#/access/eConsent

第二步:输入你的学生号(不是SSN)注册电子报表!)、姓名和电子邮件地址(可选择包含备用电子邮件地址). ECSI的网站是一个安全的网站,ECSI不会与任何人分享您的私人信息. 本电邮的目的是征求阁下同意接收电子1098-T表格.

步骤3:阅读信息,勾选复选框,单击提交.

一旦你选择以电子方式接收你的1098-T表格, 您将收到一封来自ECSI的电子邮件,其中包含如何访问的说明.

我可以从哪里获得有关此表格的其他资料? You should refer to IRS tax form 8863 and Publication 970 when completing your forms. 如果您在填写表格时遇到困难, JCC urges you to contact your accountant, tax preparer, or the Internal Revenue Service 网赌信誉排名网站用这张表格报税. Employees of JCC cannot provide tax advice.

Is this form a bill? 不,它既不是账单,也不是付款请求.

这是我必须在报税表上注明的收入来源吗? No, this form is a statement of the amount paid for qualifying tuition and related expenses during the current calendar year. However, while not an income reporting form, if scholarships and grants exceed qualified expenses then this may be considered reportable income. 你应该咨询你的税务顾问来做决定.

How is the amount determined? 请参阅如何阅读1098-T表格第1栏.

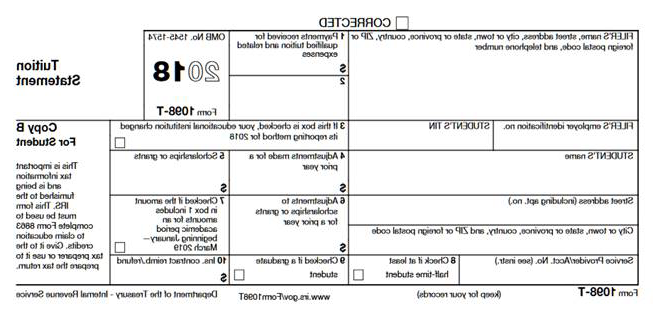

How do I read my Form 1098-T? 下面是1-10栏的示例表格和说明.

- Box 1. Please note Box 1 is payments received by JCC for qualified tuition and related expenses less refunds during the current year. Not all charges are qualifying.

- Box 2. Will be blank. 然而,资格收费是详细在您的横幅帐户. The following categories of charges are included or not included in determining qualified tuition and related expenses:

- Included charges: Tuition, general college fees, special class fees, course/lab fees, technology fee, student activity fee

- Not included charges: Fines, health insurance premiums/health fee, credit by exam/prior learning credit fee, tuition installment plan fee, room and board charges, course related books and equipment, 非学分课程的注册费, phys ed lab fee

- Box 3. 我们报告付款的方法没有改变.

- Box 4. 前一年的调整在Banner账户上有详细说明.

- Box 5. This box contains the sum of all scholarships JCC administered and processed for the student’s account during the calendar year. 支付学费(合格奖学金)和住房的奖学金, books, 其他费用(非合格奖学金)将包含在此金额中. Tuition waivers and payments received from third parties that are applied to student accounts for educational expenses are included in this box. The amount of scholarships or grants for the calendar year may reduce the amount of the education credit you claim for the year.

- Box 6 of Form 1098-T reports adjustments made to scholarships or grants reported on a prior year Form 1098-T in Box 4. The amount reported in Box 6 represents a reduction in scholarships or grants reported for a prior calendar year. The amount reported in Box 6 for adjustments to scholarships or grants may affect the amount of any allowable tuition and fees deduction or education credit you may claim for the prior year.

- Box 7. This box will be checked if the amount reported in Box 1 includes tuition or qualified amounts paid by a student account in the current year for qualifying tuition or expenses for a semester beginning in the next calendar year. For example, a payment made in December of the current year for the upcoming Spring will be reported on your current 1098-T. 框7将被选中,以表明情况确实如此.

- Box 8. Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution. If you are at least a half-time student for at least one academic period that begins during the year, 你符合美国机会信贷的条件之一. 你不必满足工作量要求,就有资格获得终身学习学分.

- Box 9. 显示你是否被认为参加了一个可以获得研究生学位的项目, graduate-level certificate, 或其他认可的研究生学历证书. This box will be blank.

- Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. This box will be blank.

如果我认为信息不正确,我应该联系谁? It is important to remember that the amount on this form consists of charges assessed by JCC in a calendar year. Contact the Business Office at 716.338.1003.

I’m a parent. 我可以把学生的1098-T表格寄给我吗? 学生必须提供所有的信息要求. The student is responsible for providing information to other parties in accordance with FERPA (Family Education Right to Privacy Act). http://www.ed.gov/policy/gen/guid/fpco/ferpa/index.html.

Can I access my 1098-T online? 要以电子方式取回1098-T表格,你必须选择加入.

如果您有任何一般性问题,请访问http://www.ecsi.net/taxinfo.有关您的税务文件的信息,并获得ECSI的网赌信誉排名网站. 如果您对您的1098-T上的信息有任何疑问, please contact your school at 716.338.1003. 如果您在登录网站时遇到问题,请随时致电866与ECSI联系.428.1098. 你的学校和ECSI都不能回答你的税务问题,你必须联系你的税务专家.

Remember, 通过确认您是通过电子方式收到此表格, a hard copy form will not be mailed to you. 然而,你可以在需要的时候经常访问网站来获取副本.

Why is it that I don’t have any information on the Form 1098-T or I never received a Form 1098-T in the mail? JCC不需要提交表格1098-T或提供声明:

- 如果你的账单金额只包括非学分课程, 即使学生以其他方式参加了学位课程.

- 非美国国籍的外国留学生.S. 以税务为目的的居民(没有在美国).S. less than 5 years).

- Students classified as non-resident aliens.

- If you paid for your enrollment fees, 但是你退了所有的课,并在那一年里收到了退款, then you would not receive a Form 1098-T.

- 如果你的地址已经过期,你的1098-T表格可能已经被退回.

为什么我的记录与1098-T表上的学杂费支付不符? When reviewing your records, please take into consideration actual registration dates in order to reconcile your records in the amounts on the form. The 1098-T form reflects payment and refunds made in the calendar year for qualifying tuition and expenses. The following expenses do not qualify as tuition and related expenses for community colleges: 1) Remote Registration Fee; 2) books; 3) parking permits; 4) housing.